The Indian Pharmaceutical Growth Story Is Led By Demand For Generics, Specialty Drugs, And CMO/API

The global pharmaceutical market is expected to grow at 3-6% CAGR to reach USD 1.6 Tn during 2021-2025, driven by growth in pharmaceutical demand in emerging markets such as Colombia, Chile, Philippines, Saudi Arabia, Taiwan, and Egypt, partially offset by lower growth in developed markets such as South Korea, Japan, France, US, Spain, Germany, Italy, UK, Australia, and Canada, due to loss of exclusivity for original brands.

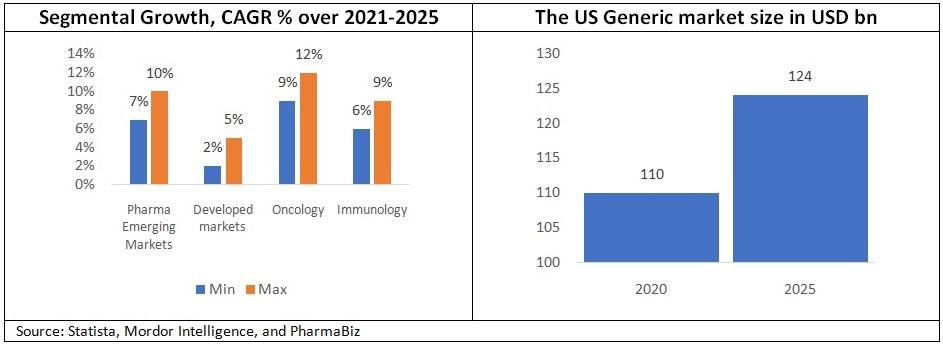

Emerging markets are expected to grow at 7-10% CAGR during 2021-2025, while developed markets will grow at 2-5% CAGR for the same period. Oncology, immunology, anti-diabetics, neurology, cardiology, anti-coagulants, and respiratory and pain are expected to be the top therapy areas. Also, it is expected that there will be higher levels of new drug launches over the next 5 years than in the decade before, in specialty, niche, and orphan drugs therapy areas. Oncology and immunology therapies are expected to grow the most at 9-12% and 6-9% CAGR, respectively, driven by increase in the number of new treatments and medicines emerging; partially offset by availability of biosimilars. Generic market is also expected to continue to grow due to patent expiries and increasing preference towards low-cost medicines.

The US is the largest pharmaceutical market in the world with an estimated size of USD 440 Bn as of 2021. It is estimated to account for over 40.0% of the global pharmaceutical market, followed by Europe at 32.0% of the market. While per capita spending on Pharmaceuticals is one of the highest amongst the developed countries, the US has the highest prices of drugs in the world. Hence, health insurers tend to control the pharmaceutical costs by encouraging the use of cheaper generic drugs in the US. Nearly 90.0% of the prescriptions sold in the US, on a volume basis, are generic drugs as of 2021 (vs. 75.0% in 2009) while the market size of the generic drugs is at USD 110 Bn only (as of 2020). It is expected to grow to USD 124.1 bn, growing at a CAGR of 12.6% over 2020-2025 (compared to 2.0% CAGR growth in it between 2016-2020). Notable factor is that generics make up only 20% of total drug spending, indicating that only 10.0% volume of branded or patented drugs account for 80% of the market value. It is believed that patented drugs may continue to command higher prices while generic drugs may continue to face pricing pressure.

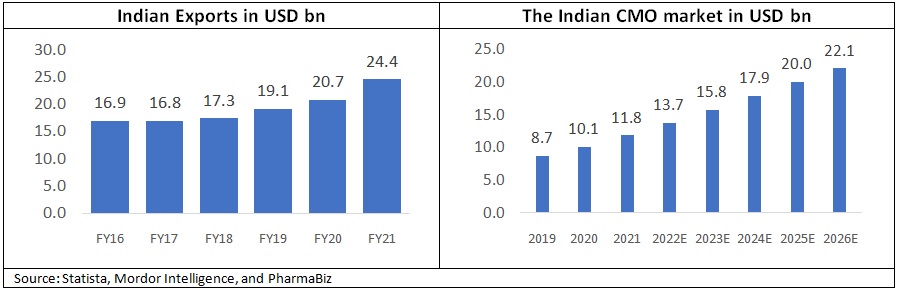

At the same time, it is believed that the number of new drug approvals in the US will continue to rise. This is likely to be driven by better understanding of genetic basis of disease and increased use of relevant diagnostics, which have been reducing the time needed for clinical trials and improving the success rate of those trials. Also, the ageing population, above 65 years of age in the US is expected to grow to 21.0% of the population by 2030 from 17.3% in 2019. These factors can continue to drive market value of branded (patented), specialty and complex generics in the US. Hence, the Indian pharmaceutical companies engaged in the US specialty and complex and branded generics products and being geographically diversified with focus on emerging markets, such as Sun Pharma, Cipla, Dr Reddy’s are likely to succeed better over a period. Sun Pharma draws 18.2% of revenue while Cipla and Dr Reddy’s generate 13.0% and 26.0% of their revenue, respectively from emerging markets, as of Q3FY22. India is the third largest producer of Pharmaceuticals in the world by volume and 14th largest by value. Also, India caters to 40.0% of generic demand in the US, 50.0% of the global demand for vaccines, and 25.0% of all medicines in the UK. In FY21, India’s Pharmaceutical exports stood at USD 24.44 bn, up 18.7% YoY, due to increase in demand for Indian generics, drug formulations and biologics.

The Global Pharmaceutical Contract Manufacturing Organization (CMO) Market was valued at USD 134.12 billion in 2021, and is expected to reach USD 204.14 billion by 2027, registering a CAGR of 6.64%. Whereas Indian CMO market is expected to grow at 13.3% CAGR to reach USD 22.07 bn by 2026. Majority of Pharmaceutical companies are focusing on development of biological drugs that could be complex and may need costlier APIs. In such instance, the API manufacturing are being outsourced by Pharmaceutical companies, largely to API manufacturers, domestically. The domestic demand for APIs is being driven by China + 1 strategy and increased production capacity of APIs domestically due to PLI scheme. Thus, companies such as Glenmark Lifesciences, Granules India, Laurus Labs, Aarti Drugs, and Divi’s Lab, which provides API supply and contract research and manufacturing can do well, over medium – long term.

To conclude, the growth in pharmaceutical companies will be driven by rising demand from emerging markets coupled with increased demand for specialty segment drugs from across the world. The growth in contract manufacturing and research and development companies will be driven by increasing demand from formulation companies for complex APIs to support manufacturing of complex biologicals.