Frequently Asked Questions (FAQs)

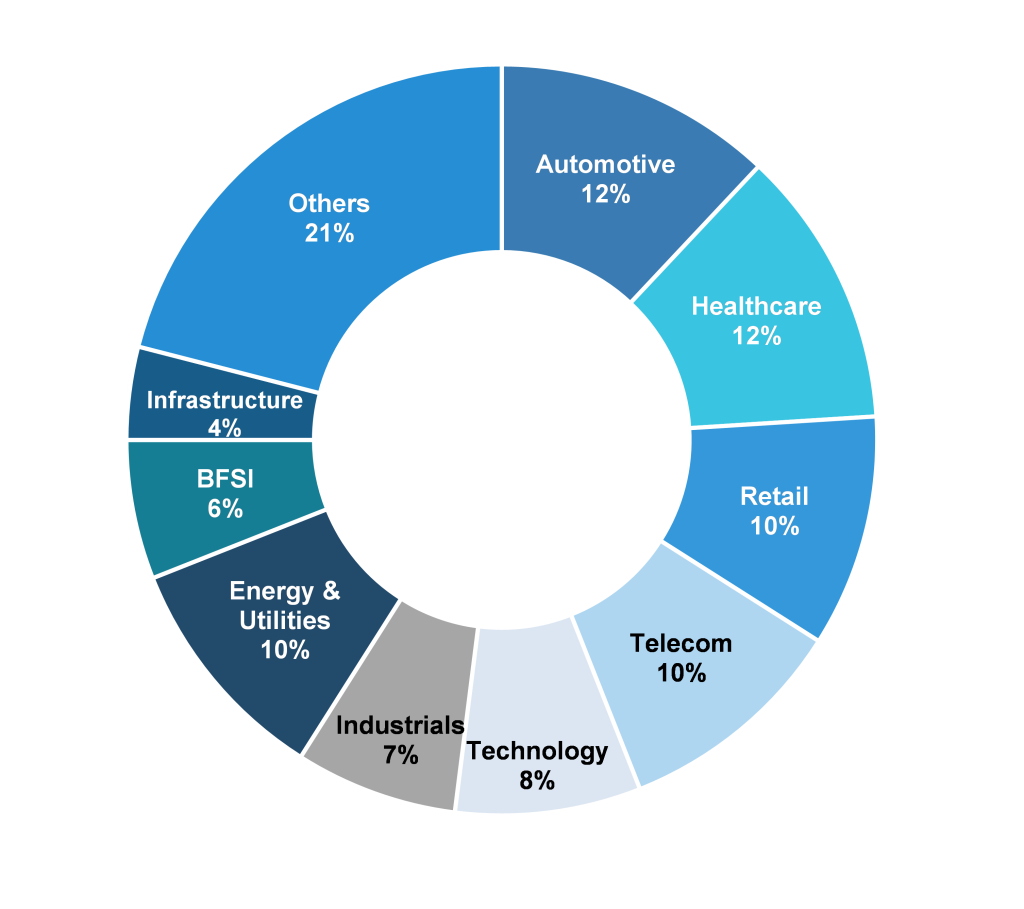

We have delivered research and analytics assignments across many sectors and sub-sectors in public and private space. We do not claim any sector expertise, however, below is our sector split of the work delivered across many clients, so far. Let us know which sector that you are interested in, and we could discuss our experience in it.

Wide Sector Coverage:

Just like our clients, we are region-agnostic. However, we have done majority of work in developed markets, including US, UK, and Europe; followed by high-end experience in MENA, LatAm and APAC (e.g., China, India).

We have delivered assignments across asset classes including equity and fixed income & credit.

Within equities, we have extensive experience with public and private equities.

And, within fixed income & credit, we are specialized in corporate credit across investment grade, high yield, leveraged loans, stressed and distressed debt.

In addition, we have done some interesting work in Environment Social and Governance (ESG) space for our existing buy/sell-side clients and also for consulting firms.

We support the asset management firms/ hedge funds/ mutual funds, across equities, credit, and ESG. We offer help across idea generation, coverage maintenance, thematic pieces, daily/ periodic news updates, Digital Transformation. For more information please visit Asset Managers and Hedge Funds page or send an inquiry here, and will get in touch soon.

Within sell-side firms, we add value to the institution and retail research functions/businesses and also the sales and trading desks, across equities, credit, and ESG. We offer help across idea generation, coverage expansion and maintenance, daily/ periodic news updates, thematic pieces, Digital Transformation. For more information please visit Sell-Side Research and Trading Desk page or send an inquiry here, and will get in touch soon.

We offer deal origination and execution support services to global investment banks, across functions including Mergers and Acquisitions (M&A), Equity Capital Markets (ECM), Debt Capital Markets (DCM), Advisory, and Loan Underwriting Risk Assessments, and Digital Transformation. For more information please visit Investment Banks page or send an inquiry here, and will get in touch soon.

Most Private Equity and Venture Capital firms leverage our services for deal origination, financial due diligence, investment portfolio monitoring and updates, and ad hoc research and analytics pieces. For more information please visit Private Equity Venture Capital page or send an inquiry here, and will get in touch soon.

We have worked with startups from concept to growth stage, and have closely worked with the founders and the founding teams to offer help across, go-to-market plans, business plans, fair valuation, and other capital raising support.

For mid-to-large corporations, we have helped clients raise growth capital, acquire companies, solve business problems using conventional research and AI/ML technologies, and accelerate organic growth with effective sales and marketing support.

For consulting firms, we help optimise their businesses by supporting across industry research updates, industry benchmarking, product benchmarking, business or financial restructuring, and loan underwriting risk assessments. For more information please visit Startups, Corporations and Consulting Firms page send an inquiry here, and will get in touch soon.

For consulting firms, we help optimise their businesses by supporting across industry research updates, industry benchmarking, product benchmarking, business or financial restructuring, and loan underwriting risk assessments. For more information please visit Startups, Corporations and Consulting Firms page send an inquiry here, and will get in touch soon.

We offer flexible engagement models that suit our client’s needs. Some popular models include, dedicated full-time equivalent (FTE) analyst, bespoke, and prepaid hours. The bespoke and prepaid hours are priced on an hourly basis, whereas the dedicated FTE analyst pricing is based on a fixed fee.

Yes, it is applicable for dedicated FTE engagement model only. And it is offered to some of the eligible clients who sign the contract for minimum 12 months. The trial period varies between 1 week and 3 months, subject to client requirements.

Around 30% of our Analyst team comprises of Chartered Financial Analyst (CFA) from The CFA Institute, USA. Typically, our analyst is a minimum MBA/ Postgraduate in Finance from a global reputed university, with minimum 2-3 years of experience in respective field of research; and some of them are between CFA I and III. They come from global/ local banks, broking firms, rating agencies, global consulting firms, captive offshore centers of global banks, and our competitors.

Yes, our clients have an option to select the analyst. Most clients care about us delivering on the agreed terms and conditions and do not want to be involved in the staffing process. However, would prefer to see the profile, the least.

The average period of replacement is between one to three months. The client can request a change in analyst if all the means to fix the gaps are exhausted. ValueAdd shall provide ~5 working days of overlap of new and exiting analyst for proper knowledge transfer (KT).

Majority clients hire us for overnight support to avail the 24/5 productivity benefits. Hence, none of the clients need a nightshift. However, we may provide nightshift if the process requires it.

Yes, the ValueAdd analyst can travel for short-to-medium at the client location. The structure of commercials includes a retainer fee, plus the travel expenses, and the per diem to cover other expenses; the actual commercials are subject to complexity of work and seniority of the analysts. The lead time may vary from one to four months, depending on the seniority of the analyst and the visa requirements.

It is quite safe. There are physical and logical access controls that restrict the information sharing. The NDAs and confidentiality clauses create a piped and secured environment for protecting the confidential data of our clients. In addition, our strict ISMS policies govern all the related stakeholders within and outside ValueAdd, including our clients, vendors, and other parties.

ValueAdd’s Compliance policy covers insider trading policies that protect any misuse of insider information. In addition, we mirror our Compliance policies with our clients’ to comply with the most stringent policies.