China’s Real Estate Debt Slump – An Opportunity For Debt Investors

DEBT INVESTORS SEE AN OPPORTUNITY IN CHINA’S REAL ESTATE DEBT SLUMP

- As default dims the overall market Outlook, Investors worry about the repayment of $292 billion of debt coming due through 2023.

- The Chinese property developers experienced their first rejection from creditors for bond extension in June 2022.

- Fed rate hikes will intensify a debt crisis for Chinese property developers.

- Banks, who have more than half exposure in the form of mortgage loans in the property sector fear as Homebuyers in China are avoiding mortgage payments, deepening the country’s real estate crisis.

- Gramercy, a $5.5 billion US-based distressed debt specialist sees potential in the context of dwindling institutional investor exposure and negative researcher’s outlook on property developers.

China is seeking to revive its $2.4 trillion (2021) real estate market, as consumer and business confidence has been battered by lockdowns with home prices falling since September 2021. The Chinese government wants to intervene to curb speculation and rein in what it calls the “three high” problems: high prices, high debt, and high financialization.

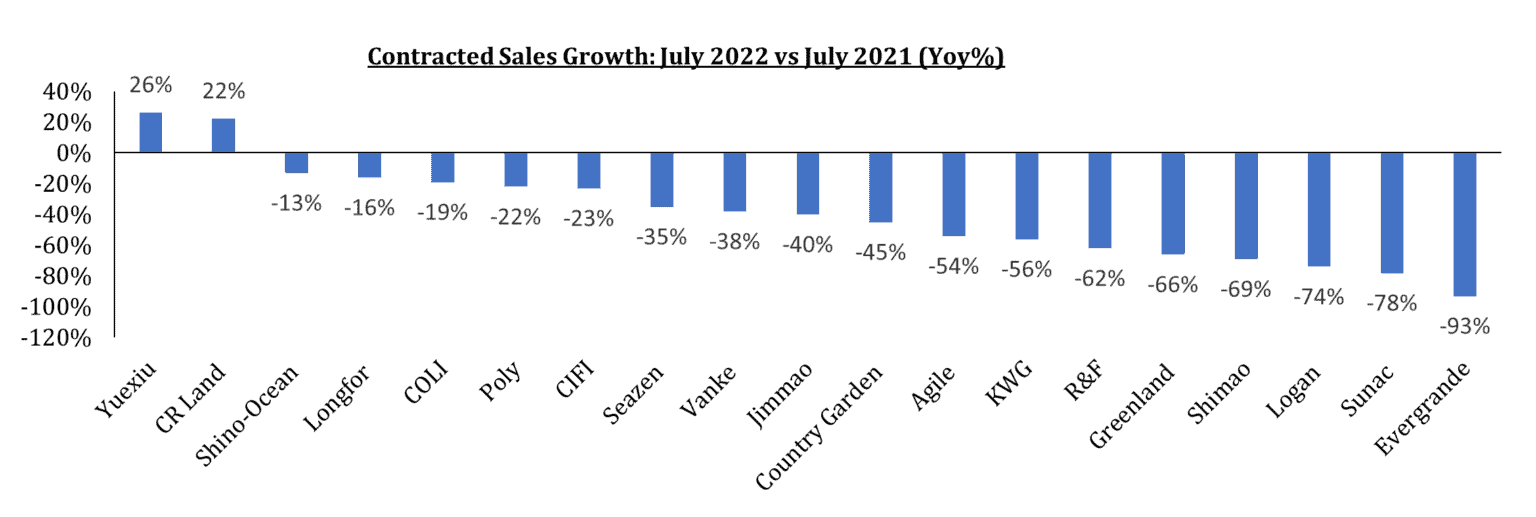

Evergrande’s Dec ’21 default triggered the industry-wide crisis, providing distressed debt funds an opportunity to binge on the distressed property business bonds in the cash-strapped Chinese real estate sector.

Investors’ Concerns About Bond Repayment

As a swelling default count dims the market outlook causing concern among fixed-income investors who commonly depended on offshore dollar bonds issued by developers to produce outsized profits during the era of ultra-low interest rates. The Chinese property developers will have to face $292 billion of debt coming due through 2023 of onshore and offshore borrowings. The developers still have $53.7 billion in borrowings due for the rest of 2022, followed by $72.3 billion of maturities in the first quarter of 2023. As market conditions have tightened, making refinancing difficult, several troubled developers have sought debt extensions. However recent events in June 2022, have demonstrated that real estate companies such as China Evergrande Group, from where it all began, have experienced their first rejection from local creditors to extend a bond payment, a development that may result in a landmark onshore default and encourage investors to take a tougher stance against other developers battered by the nation’s property debt crisis. This action will provide a new road for restructuring and will have ramifications on the pricing of real estate bonds, particularly extended bonds, with more onshore defaults expected.

Opportunity Shift From Asia’s High-Yield Dollar Debt Market To US Government Debt

Chinese property developers’ bond defaults and the rising interest rate scenario in the US have led to the flight of capital from Asia’s high-yield dollar debt market to ultra-safe US government debt.

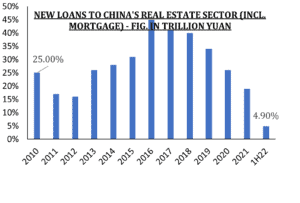

Banks Worry As Home Buyers Avoid Debt Repayment

According to a recent study, Banks have about $9.2 trillion of exposure to the property sector. More than half is in the form of mortgage loans. Due to project delays, some Chinese households have stopped servicing their mortgages for homes that remain incomplete which is a direct consequence of the increasing number of bankruptcies among developers. Chinese banks, which are already dealing with liquidity issues among developers, must now prepare for home buyer defaults. In September end, the Central bank informed that the Chinese government may relax the floor on mortgage rates for 1st time home buyers in some cities in phases in a bid to prop up property prices.

Analyst And Rating Agencies Downgrade Real Estate Companies

In June 2022, Moody stated that during the previous nine months, it has downgraded 91 high-yield Chinese property developers, and this is a record rate, given that it only granted 56 downgrades for similar firms in the ten years ending in December 2020.

Furthermore, in May 2022, Fitch anticipates China’s property sales are expected to tumble by 25-30% in CY2022.

On July 7, 2022, Charlene Chu, a senior analyst at Autonomous Research (A part of Sanford C. Bernstein & Co), anticipated that 30 companies will default with total liabilities of roughly $1 trillion. The analyst stated that while collaterals protected bank loans to developers, the issue may worsen if lenders began rotating collaterals at lower rates.

Gramercy Has A Contrarian Position And Sees Value In The Distressed Market

Foreign creditors in recent times have raised concerns about onshore investors being privileged over foreign bondholders, especially with structural subordination risk in place.

In light of institutional investors reducing exposure to Chinese Real estate and Goldman Sachs raising its FY22 China Property HY default rate forecast to 31.6% (from 19.0% in January 2022), Gramercy’s contrarian position is noteworthy. From zero exposure to the sector before Evergrande, Gramercy has built up to $200 million in corporate bonds and expects to buy more. The company stated that around 10 companies focused on trade below an inherent value which they feel can achieve by being a part of catalyzing a restructuring in a reasonable period.

Green Offshoots Over The Heavily Discounted Market

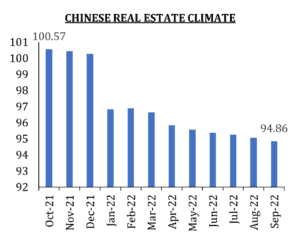

According to the National Bureau of Statistics, during the first nine months of 2022, the sale of commercial housing fell 26.3% y-o-y to 9.94 trillion yuan ($1.37 trillion) however, The housing sales in September alone rose 39.3% from August showing an upturn, Although the real estate development investment during the first three quarters fell 8% on a yearly basis to reach 10.36 trillion yuan, the investment expanded m-o-m in August and September 2022. China’s Real Estate Climate Index, which measures aggregate business activity in land sales and real estate has slumped substantially this year, with values dropping by 5.68% in September 2022 compared to last year.

Regulatory Response

In a bid to calm investors’ nerves and ensure sufficient liquidity, regulatory authorities repeatedly issued positive signals, accelerated mortgage approval and lowered mortgage interest rates, and tightened market regulation and control policies.

In response, the real estate market has shown a marginal upward trend in 2022.