FinTech: Is This Set To Poise As A Neo-Banking Or Is Only The Noise?

Guess everyone knows by now – what is FinTech?

FinTech is a buzzword that has been constantly making the right noise in technology, investments and start-up circles since last two decades. Investors across the globe are following it close on their heels. We have extreme views of experts believing that this would put an end to the traditional banking on one hand to forming a new tech bubble on the other! However, given the adoption of FinTech services globally and the investments being pumped up by global firms, instil a huge confidence in the potential prospect of this industry & its applications. FinTech has given rise to a start-up scene of over 4,000 firms with business models that span across lending, payments, personal finance, remittance, investments, securities trading and savings. Its importance was reinforced during the global financial crisis of 2008 that highlighted the inefficiencies in the banking system and prodded the tech industry to understand and take advantage of the numerous opportunities presented by the financial world. FinTech has helped digitize the financial sector, reshaping businesses and transforming the way consumers use and manage money. Prominent FinTech brands in the industry include Bitcoin, LendingCLub, PayPal, Tencent, Check, OnDeck, Future Advisor, FundBox and Kreditech, among others.

What is the investment outlook by 2020? Currently, who are the leading investors?

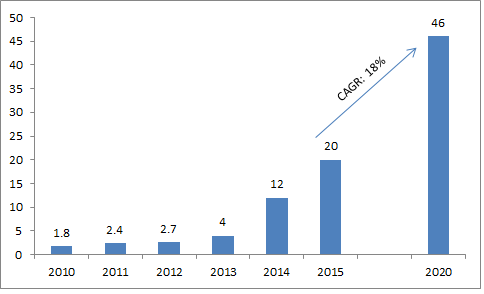

According to Goldman Sachs, the FinTech sector promises a pot of revenues to the tune of US$4.7 tn that investors across the globe are hitting on. Investors are pouring in billions of dollars into financial start-ups across the globe and have in fact quintupled their investments, from US$4 bn in 2013 to US$20 bn in 2015; and are expected to grow to US$46 bn by 2020, on the back of further advancements in technology and innovative financial products. Investor groups, across segments, have exhibited interest in the sector, with venture capital firms contributing 24% to the total investments, private equity firms 15%, angel investors 12% and corporate & other investors 49%. Few investors (and their investments) that have hit the spotlight include SoftBank (SoFi), Baseline ventures (Millenial Personal Finance), Alibaba (PayTm), General Atlantic (Avant), Google (Symphony), Intel (IntelSee), Salesforce (SalesForce Financial Services Cloud), JP Morgan Chase (Bunker), Master Card (Pinpoint-loyalty provider) and Pingan (Lufax). The frontrunners in attracting these investments, as of Jan 2016, were payments/loyalty/Ecommerce firms (51%), followed by Banking/Lending firms (41%). The remaining share of investments (8%) has been made in securities/capital markets, wealth management, financial BPOs, financial management, insurance technology, and FinHCIT companies.

But what has convinced so many investors for betting their money in FinTech firms?

The emergence of new technologies such as Blockchain (public ledger account for Bitcoin transactions), Internet of Things (IoT), machine learning or artificial intelligence (AI), cloud-based solutions, Big-data and the increased coverage expansion of mobile apps has turned the traditional model of financing on the head and is driving financial innovation. It has eased monetary transactions, ensured faster processing, reduced documentation requirements, improved risk management, made investments easier and reduced the cost of financial services. The internet savvy young population has supported greater usage of card payment methods, higher smartphone penetration, online payments and at the Point of sale terminals transactions. Such a change in consumer behaviour is driving a myriad of advancements in FinTech.

Another key driver for FinTech start-ups is the rise of Small & Medium Enterprises (SMEs), which are constantly in search for adequate low-cost funds and need customized solutions for processing merchant card payments, supply chain financing, and credit & expense management. The lower interest rates charged by the online lending platforms such as Peer to Peer lending and CrowdFunding, has made it attractive for SMEs to borrow money from these platforms. The lower cost and higher returns offered by FinTech services is due to absence of significant hurdles and overhead costs that traditional banks are subject to. For instance, Prosper, a P2P lending platform offers average returns of ~7%, while it is only ~1-2% for deposit holders in a traditional US bank.

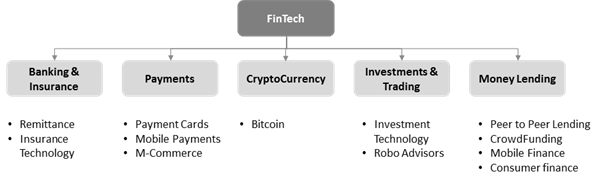

Each of the sub-segments of FinTech has shown exponential growth in the past few years. According to a global survey conducted by Business.com in 2015, nearly 30% individuals with smartphones prefer using mobile payment services over cash or card transactions. Bitcoin, another major sub-segment of FinTech is changing the way we use currency. As of 2015, nearly 6 million people across the globe used Bitcoin for various transactions for its faster processing and higher security associated with its usage. Similarly, other segments like payments, money lending, roboadvisors etc. offer unmatched opportunity for investors. We will be discussing more on each of these sub-segments in this blog series. We leave you with a quick list of services or sub-segments of FinTech. Watch out for our next post!

Source: ValueAdd

This article is authored by Girish Bhise (Founder & CEO of ValueAdd)

About The Author:

Girish has over 15 years of research experience across investment banking, equity research, fixed income and credit research, and business strategy research for large global clients including asset management firms, investment banks, brokerage firms, corporations, private equity & venture capital firms. Has extensive experience in successfully managing large-scale research right-shoring transitions across multiple regions. Is a thought-leader in the global research & technology industry. He is an MBA with specialization in Finance from the University of Pune, and Bachelor in Commerce from the University of Mumbai.

Please share your feedback/comments/thoughts on girish.bhise@valueadd-research.com. Thank you for time.

FinTech is a buzzword that has been constantly making the right noise in technology, investments and start-up circles since last two decades. Investors across the globe are following it close on their heels. We have extreme views of experts believing that this would put an end to the traditional banking on one hand to forming a new tech bubble on the other! However, given the adoption of FinTech services globally and the investments being pumped up by global firms, instil a huge confidence in the potential prospect of this industry & its applications. FinTech has given rise to a start-up scene of over 4,000 firms with business models that span across lending, payments, personal finance, remittance, investments, securities trading and savings. Its importance was reinforced during the global financial crisis of 2008 that highlighted the inefficiencies in the banking system and prodded the tech industry to understand and take advantage of the numerous opportunities presented by the financial world. FinTech has helped digitize the financial sector, reshaping businesses and transforming the way consumers use and manage money. Prominent FinTech brands in the industry include Bitcoin, LendingCLub, PayPal, Tencent, Check, OnDeck, Future Advisor, FundBox and Kreditech, among others.

What is the investment outlook by 2020? Currently, who are the leading investors?

According to Goldman Sachs, the FinTech sector promises a pot of revenues to the tune of US$4.7 tn that investors across the globe are hitting on. Investors are pouring in billions of dollars into financial start-ups across the globe and have in fact quintupled their investments, from US$4 bn in 2013 to US$20 bn in 2015; and are expected to grow to US$46 bn by 2020, on the back of further advancements in technology and innovative financial products. Investor groups, across segments, have exhibited interest in the sector, with venture capital firms contributing 24% to the total investments, private equity firms 15%, angel investors 12% and corporate & other investors 49%. Few investors (and their investments) that have hit the spotlight include SoftBank (SoFi), Baseline ventures (Millenial Personal Finance), Alibaba (PayTm), General Atlantic (Avant), Google (Symphony), Intel (IntelSee), Salesforce (SalesForce Financial Services Cloud), JP Morgan Chase (Bunker), Master Card (Pinpoint-loyalty provider) and Pingan (Lufax). The frontrunners in attracting these investments, as of Jan 2016, were payments/loyalty/Ecommerce firms (51%), followed by Banking/Lending firms (41%). The remaining share of investments (8%) has been made in securities/capital markets, wealth management, financial BPOs, financial management, insurance technology, and FinHCIT companies.

But what has convinced so many investors for betting their money in FinTech firms?

The emergence of new technologies such as Blockchain (public ledger account for Bitcoin transactions), Internet of Things (IoT), machine learning or artificial intelligence (AI), cloud-based solutions, Big-data and the increased coverage expansion of mobile apps has turned the traditional model of financing on the head and is driving financial innovation. It has eased monetary transactions, ensured faster processing, reduced documentation requirements, improved risk management, made investments easier and reduced the cost of financial services. The internet savvy young population has supported greater usage of card payment methods, higher smartphone penetration, online payments and at the Point of sale terminals transactions. Such a change in consumer behaviour is driving a myriad of advancements in FinTech.

Another key driver for FinTech start-ups is the rise of Small & Medium Enterprises (SMEs), which are constantly in search for adequate low-cost funds and need customized solutions for processing merchant card payments, supply chain financing, and credit & expense management. The lower interest rates charged by the online lending platforms such as Peer to Peer lending and CrowdFunding, has made it attractive for SMEs to borrow money from these platforms. The lower cost and higher returns offered by FinTech services is due to absence of significant hurdles and overhead costs that traditional banks are subject to. For instance, Prosper, a P2P lending platform offers average returns of ~7%, while it is only ~1-2% for deposit holders in a traditional US bank.

Each of the sub-segments of FinTech has shown exponential growth in the past few years. According to a global survey conducted by Business.com in 2015, nearly 30% individuals with smartphones prefer using mobile payment services over cash or card transactions. Bitcoin, another major sub-segment of FinTech is changing the way we use currency. As of 2015, nearly 6 million people across the globe used Bitcoin for various transactions for its faster processing and higher security associated with its usage. Similarly, other segments like payments, money lending, roboadvisors etc. offer unmatched opportunity for investors. We will be discussing more on each of these sub-segments in this blog series. We leave you with a quick list of services or sub-segments of FinTech. Watch out for our next post!

Fintech Subseg new (3) Source: ValueAdd

This article is authored by Girish Bhise (Founder & CEO of ValueAdd) About The Author: Girish has over 15 years of research experience across investment banking, equity research, fixed income and credit research, and business strategy research for large global clients including asset management firms, investment banks, brokerage firms, corporations, private equity & venture capital firms. Has extensive experience in successfully managing large-scale research right-shoring transitions across multiple regions. Is a thought-leader in the global research & technology industry. He is an MBA with specialization in Finance from the University of Pune, and Bachelor in Commerce from the University of Mumbai.

Please share your feedback/comments/thoughts on girish.bhise@valueadd-research.com. Thank you for time.