Top 7 Trends To Watch For In The Global Investment Banking Industry In 2022

The outbreak of COVID-19 pandemic brought about an irrevocable change in the banking industry. While the pandemic prompted banks to adopt digital change in 2020 and 2021, that change would be institutionalised in 2022, marking the advent of a new normal. Post reopening of international markets, there was a noticeable surge in activity in the investment banking sector. After a relatively flat growth during H1 2022, new business opportunities for investment bankers would open up during H2 2022 owing to the consistent turnaround and revival of negatively impacted industries as well as anticipated higher growth trajectory. All verticals of the industry including Initial Public Offerings (IPOs), Mergers and Acquisitions (M&A), Private Equities (PEs), Special Purpose Acquisition Companies (SPACs), Restructuring and Debt Advisory are expected to gain momentum and witness unparalleled growth. Certain key medium term trends to look for in the industry are as follows:

1.Sustainable Finance to be a key focus area:

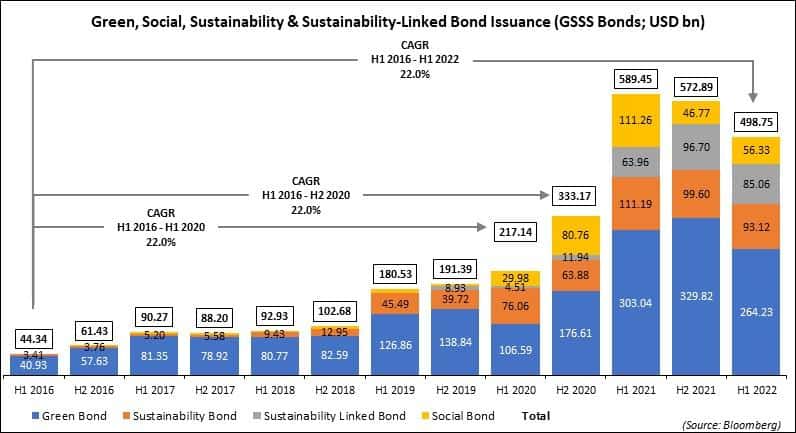

Sustainable finance refers to investment decisions which consider the Environmental, Social and Governance (ESG) factors of any economic activity or a project. Although it is not a new concept, sustainable finance is gaining more traction after the COVID-19 pandemic’s outbreak impact as well as global \events such as COP26 climate conference. Certain other high-profile stimulus for sustainability finance include the Sustainable Development Goals (SDGs) released by United Nations (UN) to protect the planet, end poverty, and ensure that by 2030 all the people enjoy peace & prosperity and the Task Force on Climate-related Financial Disclosures (TCFD) to improve and increase reporting of climate-related financial information. Such initiatives are driving the growth of ESG investments as corporate stakeholders and investors are increasingly focusing on implementing mandatory ESG policies and regulations. Owing to the climate change commitments, Sustainability-Linked Bonds (SLB) have been booming. A significant level of uncertainty in the volatile environment mainly driven by effects of Russia’s invasion of Ukraine coupled with inflationary pressures and prospects for accelerated monetary policy tightening have resulted in a marginal drop in Green, Social, Sustainability and Sustainability-Linked (GSSS) bond volumes during H1 2022. The volumes are expected to rebound during the second half of 2022 as more issuers would resume long-term sustainable financing plans.

2.Strong Appetite for M&A:

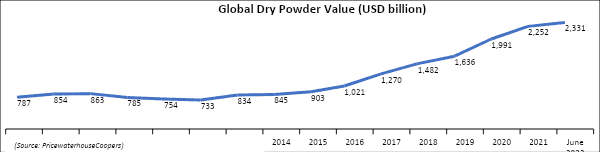

2021 was observed as a great year for global M&A with more than 60,000 publicly disclosed deals breaking USD 5.0 trillion value for the first time. Headwinds such as supply chain resilience, ESG, portfolio optimisation as well as need for technology to digitalise business models underpinned the global M&A market in H12022. With fresh emerging headwinds like lower stock prices, rapidly accelerating inflation & interest rates as well as the energy crisis deepened by the Russia–Ukraine conflict, the global M&A market is expected to remain low compared to the record breaking 2021 levels but close to the pre-pandemic levels. Private Equity (PE) is a perpetual source of deal-making capital which, despite the market challenges, can be counted on to drive deal volumes. Just before the outbreak of COVID-19 pandemic, PE had doubled compared to the level at the beginning of global financial crisis of 2007–08. While PE investment has risen, rising interest rates and inflation have made it much more difficult to generate returns. To speed up and better inform their deal processes as well as to widen the investment portfolio in new industries & asset classes, it is anticipated that PEs would leverage cloud technologies and data-driven insights more frequently.

3.SPAC boom continues with near term concerns:

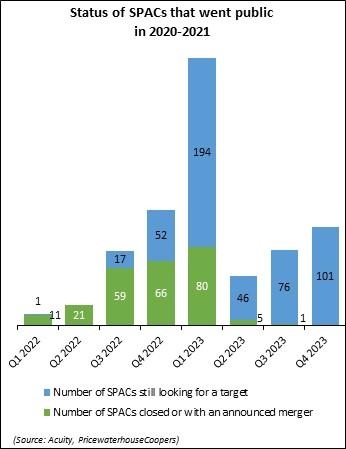

SPACs began witnessing a boom in late 2020 and early 2021. There are around 500 SPACs that are yet to announce a merger and close a deal by late 2022 or early 2023. SPACs are expected to play a significant role in M&A as they would continue to compete against corporates and PEs for sought-after assets. The sharp rise in SPACs drew the attention of Securities and Exchange Commission (SEC) and on March 30, 2022, SEC proposed new rules and amendments intended to enhance disclosure and investor protections in SPAC IPOs and business combination transactions between shell companies and private operating companies. This may lead to a temporary slowdown in activity, but the popularity of SPACs would continue to persist. Despite the positives, there are also challenges and concerns regarding the structure of the SPAC method. Among other concerns major are, expenses for target company, quality sponsor, time constraints, high risk for all retail investors. Also as see in the chart the number of SPACs still looking for target is much higher than number of them closed or announced merger

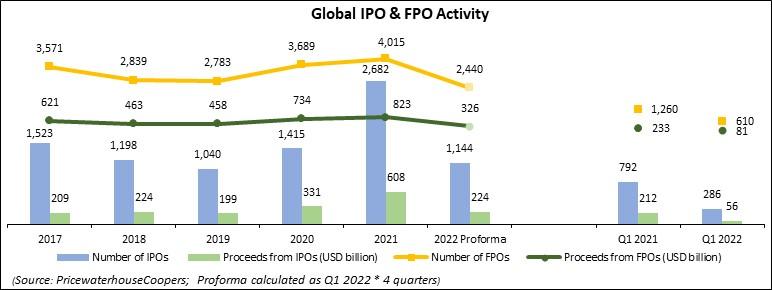

4. Capital markets activity returning to pre-pandemic levels:

Year 2022 began with more concerns over the IPO pricing and over the potential impact of renewed inflationary risks to the global economy and to corporate prospects. Although Omicron variant’s influence was less long-lasting than predicted, more volatile and challenging markets for IPOs already existed before the war in Ukraine, which unavoidably considerably slowed IPO activity in many nations. Worldwide indexes ended Q1 2022 lower than Q4 2021 indicating that volatility levels have returned to those seen in 2020 during the height of the global pandemic. At this stage, it is difficult to estimate when the appetite for IPOs will return. Although there is still a lot of investor liquidity, inflationary concerns are still a major issue and market volatility makes it difficult to “right price” an IPO. Until there is a clearer path for resolution, the Ukraine war will have a significant impact on public opinion. With rising focus of equity investors on ESG, proposed rule amendments by SEC which would make it mandatory for public corporations to provide certain climate-related information in their periodic reports and registration statements.

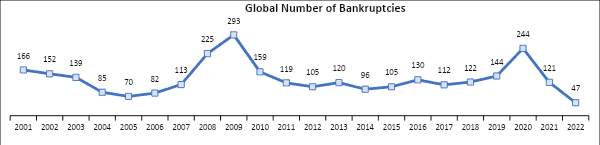

5. Increase in demand for restructuring and debt advisory:

The worldwide economy has been significantly impacted by outbreak of COVID-19 pandemic. Due to the disruption of economic activity and high debt levels, borrowers are more susceptible to the risk of default and bankruptcy. Many businesses were already troubled before the outbreak and the crises has merely hastened their fall. This has resulted in significant and unexpected demand for debt advising and restructuring services which is expected to remain elevated. Thankfully, the global bankruptcies have decreased in 2021 and 2022, from the peak of 2020.

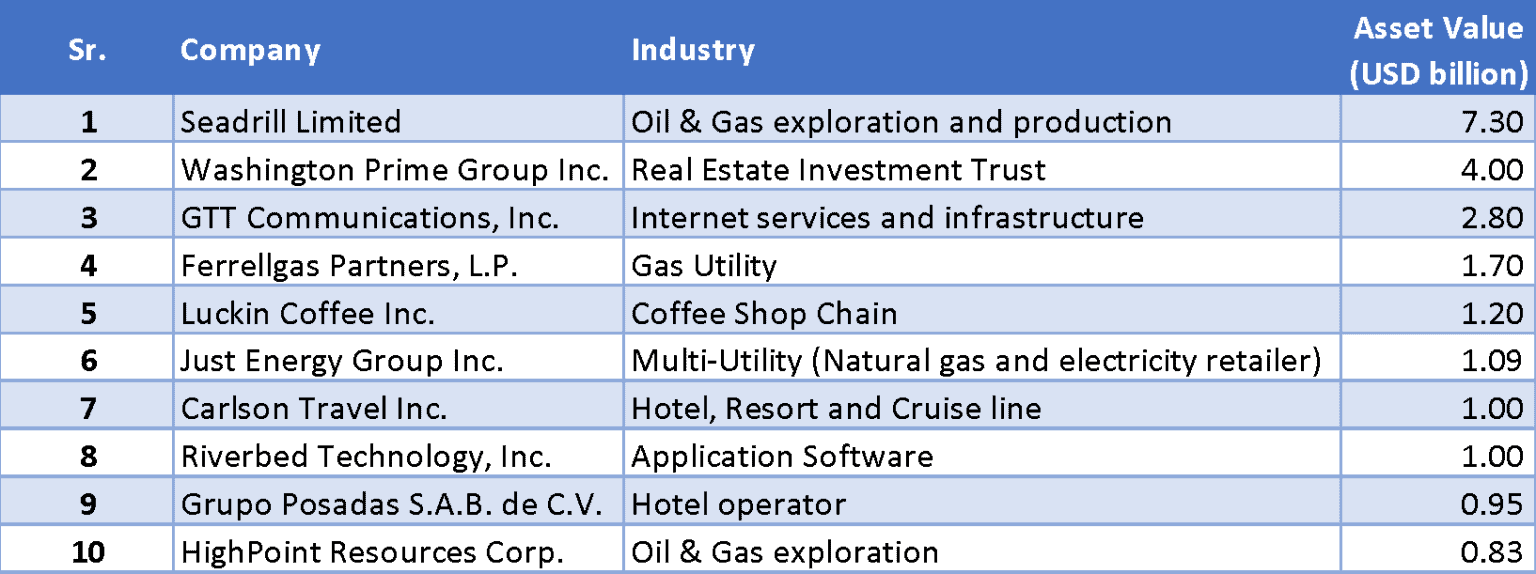

Largest Public Company Bankruptcy Filings of 2021

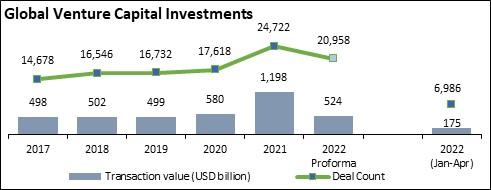

6.Surge of investment in start-ups by Venture Capitals:

Venture Capital (VC) investments have reached record highs due to a rise in shares, improved liquidity as well as rising interest in industries which have profited from the coronavirus outbreak. Later-stage start-ups continue to receive venture funding driven by euphoria of certain significant later stage exits.

7.High Attrition Rate:

Around 5.0% of the employees are expected to exit after receiving their annual bonuses in the investment banking industry. Investment Banks across the globe have been struggling with shortage of talented employees and massive workloads amidst surge in dealmaking. In the high-stress post-pandemic environment, the once-desired career in investment banking may be losing its charm and the sector must transform to meet its objectives. The mid and senior-level talent pool is being attracted by a variety of factors such as appealing job profiles, higher pay packages and sizable ESOPs.

Are there any new trends you see in your region? Please feel free to share in the comments. Thank you!