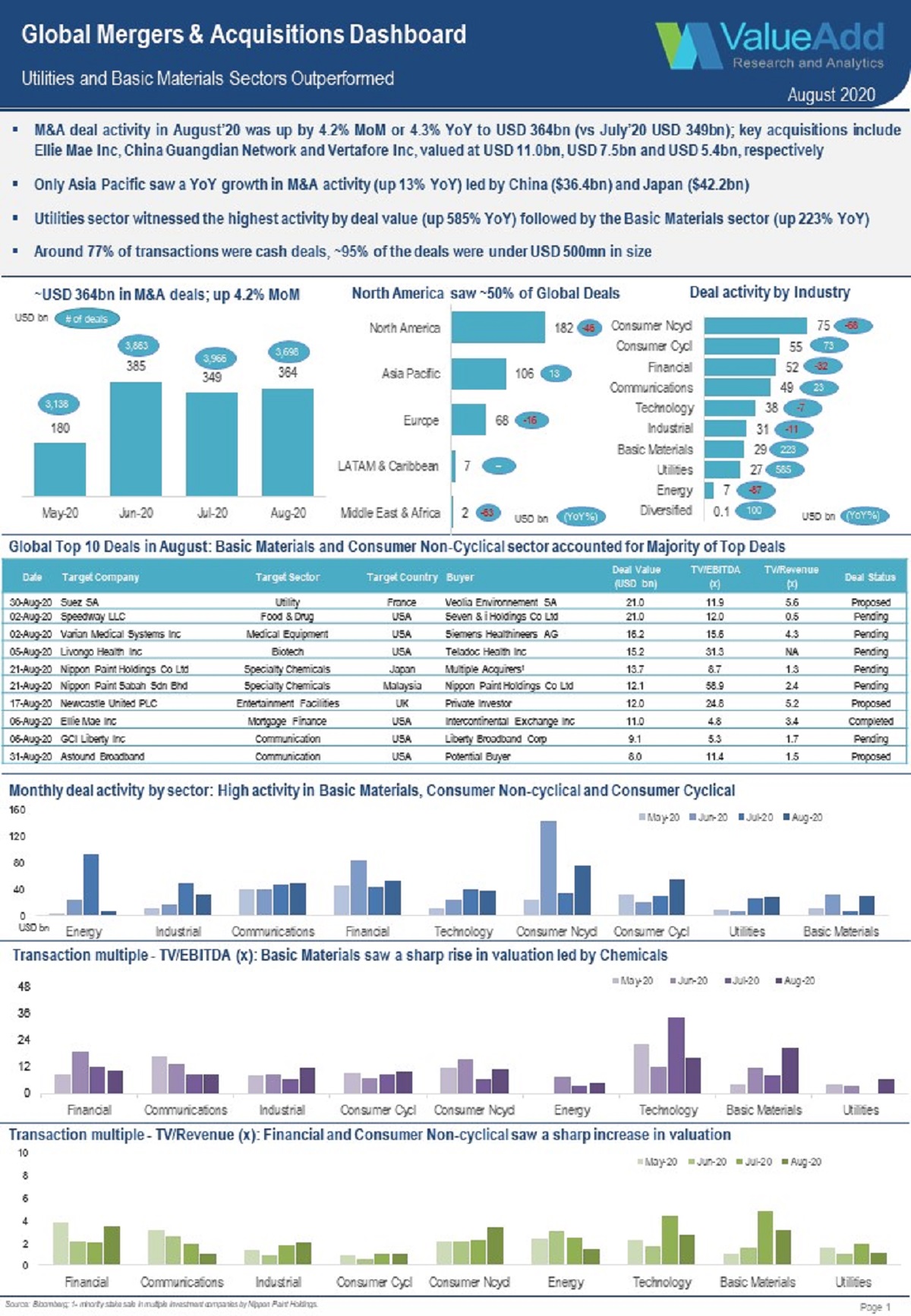

Global Mergers & Acquisitions Dashboard For August 2020

The M&A deal activity in August’20 was up by 4.2% MoM or 4.3% YoY to USD 364bn (vs July’20 USD 349bn) primarily led by Utilities and Basic Materials Sectors. Among all regions, only Asia Pacific posted a 13% YoY growth in deals led by China and Japan. Some key global deals include Ellie Mae Inc, China Guangdian Network and Vertafore Inc, valued at USD 11.0bn, USD 7.5bn and USD 5.4bn, respectively.

DISCLAIMER

This document sample has been prepared by ValueAdd Research & Analytics Solutions (“ValueAdd”). This is illustrative and is designed for marketing purposes only.

This document should not be considered as investment advice or a recommendation, or an offer to sell or a solicitation to buy, or an endorsement or recommendation of any company.

The information has been compiled or arrived at from sources believed to be reliable and accurate at the time of this analysis and in good faith. ValueAdd makes no representation or warranty, express or implied as to, nor has it verified, the accuracy, completeness, correctness, and authoritativeness of the information. Accordingly, ValueAdd accepts no liability for any direct or consequential loss or damage arising from (i) the use of this communication, (ii) reliance on any information contained herein, (iii) any error, omission, or inaccuracy in any such information, or (iv) any action resulting therefrom. Authorized recipients should verify the factual accuracy, assumptions, calculations, and completeness of the information.

This document should not be reproduced in any form or distributed (in whole or in part) to any third party without the express prior written permission of ValueAdd.